Bayer stock has been a topic of interest among investors, analysts, and market enthusiasts alike. As a major player in the pharmaceutical and life sciences sectors, Bayer AG's stock performance reflects broader economic trends and the company's strategic decisions. In this article, we'll delve into various aspects of Bayer stock, including its historical performance, market position, recent developments, and future outlook. Whether you're a seasoned investor or a newcomer to the stock market, understanding Bayer's stock dynamics is crucial for making informed investment decisions.

In a world where financial markets can be volatile and unpredictable, Bayer AG stands out due to its diverse portfolio and commitment to innovation. This analysis aims to equip you with critical insights into Bayer stock, helping you navigate its complexities with confidence. We will explore key financial metrics, expert opinions, and market trends that could impact Bayer's stock performance in the coming years. So, let's dive deeper into the world of Bayer stock and uncover what it means for your investment strategy.

The journey of Bayer AG has been marked by significant milestones, challenges, and triumphs. From its inception in 1863 to becoming a global leader in pharmaceuticals and agriculture, Bayer's story is one of resilience and growth. As we assess Bayer stock, we will also highlight the company's efforts toward sustainability and corporate responsibility, which are increasingly important for investors today. Join us as we explore all facets of Bayer stock and its implications for your investment portfolio.

- Exploring The Iconic Movies Of Michael Keaton A Comprehensive Guide

- Exploring The Enigmatic Folklore Album Cover A Deep Dive Into Its Meaning And Impact

Table of Contents

- 1. Historical Performance of Bayer Stock

- 2. Bayer's Market Position

- 3. Recent Developments Impacting Bayer Stock

- 4. Financial Analysis of Bayer AG

- 5. Expert Opinions on Bayer Stock

- 6. Future Outlook for Bayer Stock

- 7. Bayer's Sustainability Initiatives

- 8. Conclusion

1. Historical Performance of Bayer Stock

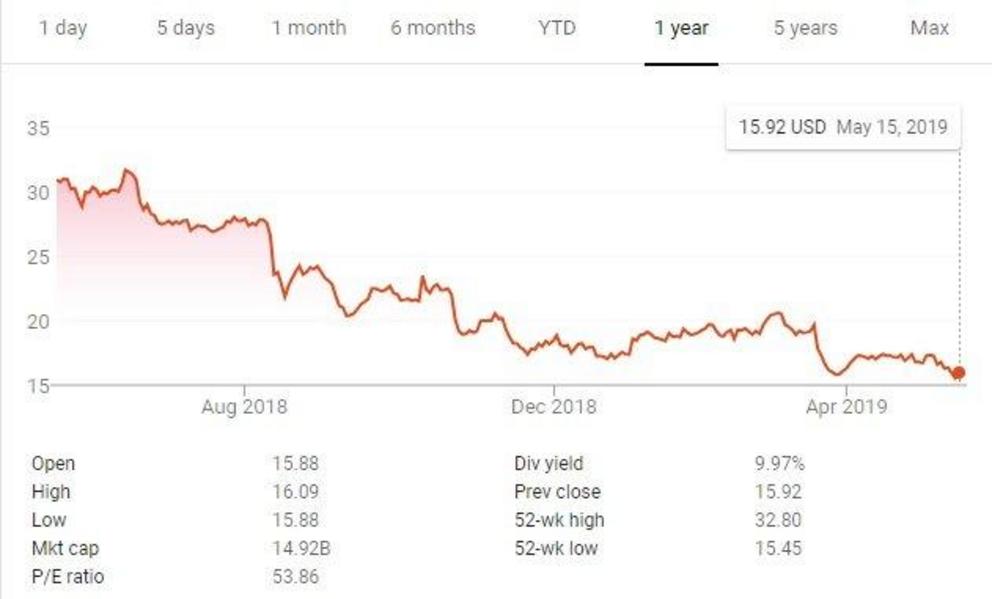

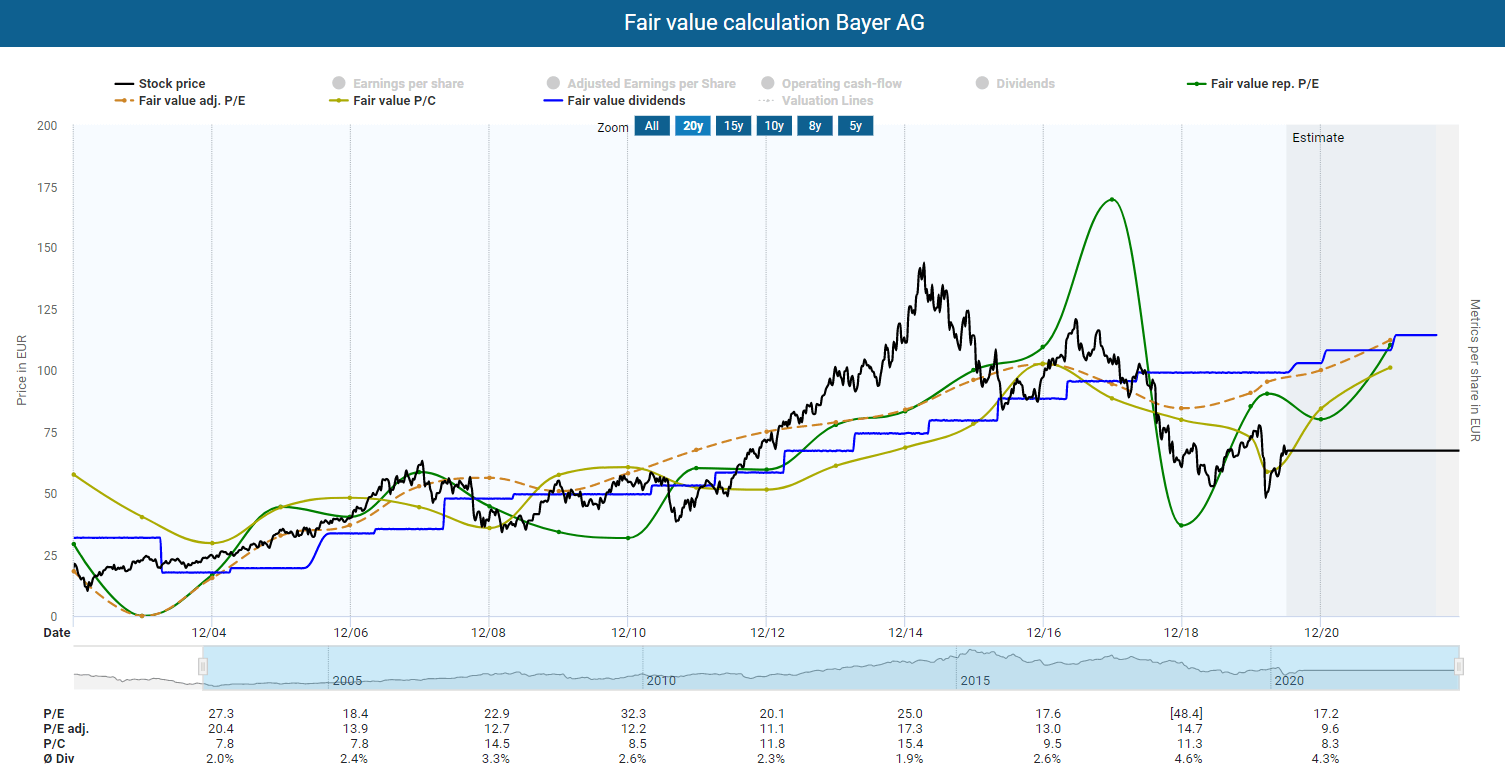

Bayer's stock has experienced various ups and downs over the decades. Investors often look at historical performance to gauge future potential. The stock was listed on the Frankfurt Stock Exchange in 1880 and since then, it has gone through several phases of growth and challenges.

Key Milestones

- 1995: Bayer's merger with Agfa-Gevaert.

- 2002: Bayer's reorganization and focus on pharmaceuticals.

- 2016: Acquisition of Monsanto, significantly expanding its agricultural portfolio.

The acquisition of Monsanto was particularly controversial but has since provided Bayer with a strong foothold in the agricultural sector, diversifying its revenue streams.

2. Bayer's Market Position

Bayer AG operates in multiple sectors, including pharmaceuticals, consumer health, and crop science. This diversification helps stabilize the company's performance across different market conditions.

- Selena Gomez Show A Deep Dive Into Her Impact On Entertainment

- Family Christmas Movies A Heartwarming Guide To Holiday Classics

Pharmaceutical Segment

Bayer's pharmaceutical segment is renowned for its innovative treatments in areas like oncology, cardiology, and women's health. Products like Xarelto and Eylea contribute significantly to revenue.

Consumer Health Segment

The consumer health division offers products ranging from over-the-counter medications to nutritional supplements. This segment has seen steady growth, particularly during the pandemic.

Agricultural Science Segment

The agricultural science segment is crucial for Bayer's long-term strategy, especially given the increasing global demand for food and sustainable farming solutions.

3. Recent Developments Impacting Bayer Stock

Recent developments, including regulatory changes, product launches, and market trends, can significantly impact Bayer's stock price. Some key events include:

- Regulatory approval for new drugs.

- Litigations related to glyphosate and its impact on stock performance.

- Partnerships with biotech firms for innovative treatments.

4. Financial Analysis of Bayer AG

Examining Bayer's financial metrics is essential for understanding its stock potential. Key indicators include:

- Revenue growth rate.

- Earnings before interest and taxes (EBIT).

- Price-to-earnings (P/E) ratio.

As of 2023, Bayer reported a revenue of approximately €43 billion, with a P/E ratio of 12.5, indicating a relatively undervalued stock compared to industry peers.

5. Expert Opinions on Bayer Stock

Financial analysts and experts often provide insights and forecasts regarding Bayer stock. Many analysts view Bayer as a solid long-term investment, given its diversified portfolio and commitment to innovation. However, opinions can vary based on market conditions and company performance.

- Analyst A: Positive outlook due to new drug pipelines.

- Analyst B: Caution advised due to ongoing litigations.

6. Future Outlook for Bayer Stock

The future outlook for Bayer stock hinges on several factors, including successful product launches, resolution of litigations, and expansion into emerging markets. Analysts suggest that Bayer's focus on research and development will be critical for sustaining growth.

7. Bayer's Sustainability Initiatives

In today's investment landscape, sustainability is becoming increasingly important. Bayer has committed to various sustainability initiatives, including:

- Reducing greenhouse gas emissions.

- Promoting sustainable agriculture practices.

- Investing in environmentally friendly product development.

These initiatives not only enhance Bayer's reputation but also align with the growing demand for socially responsible investing.

8. Conclusion

In summary, Bayer stock presents a compelling opportunity for investors seeking exposure to the pharmaceutical and agricultural sectors. With a solid historical performance, a diverse market position, and a commitment to sustainability, Bayer AG is well-positioned for future growth. However, potential investors should also consider the risks associated with ongoing litigations and market volatility. As always, thorough research and analysis are key to making informed investment decisions.

We encourage you to share your thoughts in the comments below, and don't forget to explore our other articles for more insights into the investment world!

Thank you for reading! We hope to see you back for more informative content about stocks and investment strategies.

- Venus And Serena Williams Family A Deep Dive Into Their Roots And Relationships

- Ghost The Legacy Of Patrick Swayze