The Nikkei Share Index, often referred to simply as the Nikkei, is a crucial barometer for the Japanese economy and stock market. As one of the most recognized indices in Asia, it provides insights into the performance of Japan's largest and most influential companies. For investors and analysts, understanding the Nikkei is essential for making informed decisions regarding their investments in Japan.

The Nikkei 225, which is the most well-known version of the Nikkei index, comprises 225 of the top companies listed on the Tokyo Stock Exchange. These companies span various sectors, making the index a comprehensive representation of Japan's economic landscape. In this article, we will delve into the intricacies of the Nikkei Share Index, its historical significance, and its implications for global investors.

As we navigate through this extensive exploration of the Nikkei Share Index, we will cover its methodology, historical performance, and the factors influencing its fluctuations. Whether you are a seasoned investor or a newcomer to the world of finance, this article aims to equip you with valuable information about one of Asia's most important financial indicators.

- In The Fire Understanding The Dynamics And Impact Of Fire In Nature And Society

- Stacy Degrandchamp A Comprehensive Look At Her Life And Career

Table of Contents

- What is the Nikkei Share Index?

- History and Evolution of the Nikkei

- Components of the Nikkei 225

- Calculation Methodology of the Nikkei

- Factors Influencing the Nikkei Share Index

- Investing in the Nikkei Share Index

- The Nikkei and the Global Economy

- Future Outlook for the Nikkei Share Index

What is the Nikkei Share Index?

The Nikkei Share Index is a stock market index that represents the performance of 225 large companies listed on the Tokyo Stock Exchange (TSE). It is often viewed as a key indicator of Japan's economic health and investor sentiment. The index was first published in 1950 and has since become a critical tool for analysts and investors worldwide.

Importance of the Nikkei Index

- Provides a snapshot of the Japanese economy.

- Aids investors in making informed decisions.

- Reflects market trends and investor sentiment.

History and Evolution of the Nikkei

The history of the Nikkei Share Index dates back to 1950 when it was created to provide a comprehensive view of Japan's post-war economic recovery. Initially, it included 225 companies, and its methodology has evolved over the years to reflect changes in the market dynamics.

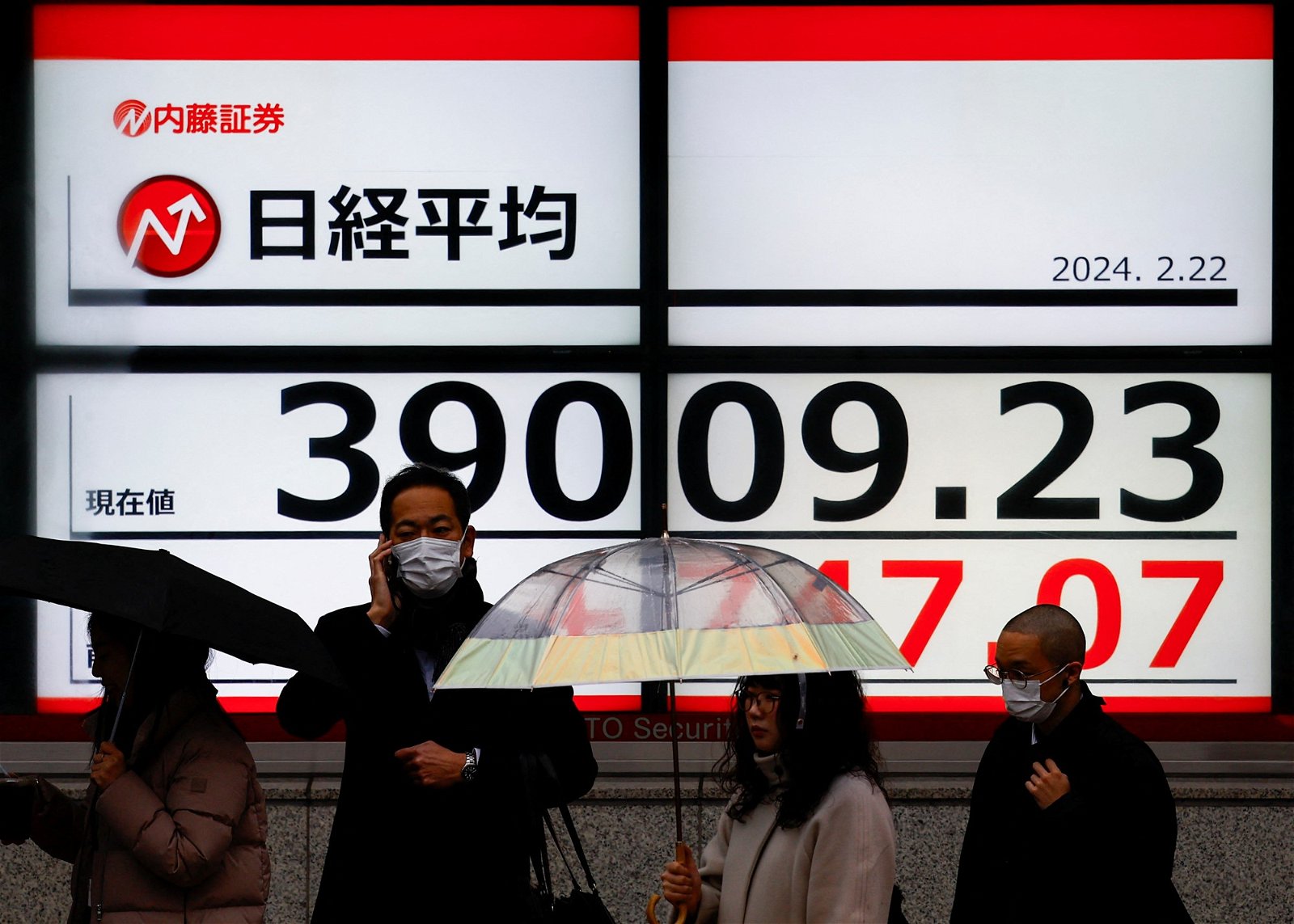

In the 1980s, during Japan's economic bubble, the Nikkei reached an all-time high of nearly 39,000 points. However, the subsequent crash led to years of stagnation, known as the "Lost Decade." In recent years, the Nikkei has shown signs of recovery, influenced by both domestic policies and global economic conditions.

- Finding Your Roots Season 10 A Deep Dive Into Ancestry Exploration

- Laura Coates A Deep Dive Into The Life And Career Of A Legal Expert And Cnn Anchor

Components of the Nikkei 225

The Nikkei 225 is composed of various sectors, including technology, automotive, finance, and consumer goods. Some of the most notable companies included in the index are:

- Sony Corporation

- Toyota Motor Corporation

- SoftBank Group Corp.

- Honda Motor Co., Ltd.

- Mitsubishi UFJ Financial Group

Biodata of Nikkei 225

| Index Name | Nikkei 225 |

|---|---|

| Country | Japan |

| First Published | 1950 |

| Number of Companies | 225 |

| Exchange | Tokyo Stock Exchange |

Calculation Methodology of the Nikkei

The Nikkei 225 is calculated using a price-weighted methodology, meaning that companies with higher stock prices have a greater influence on the index's value. This method contrasts with market capitalization-weighted indices, where larger companies have a more significant impact based on their overall market value.

To calculate the Nikkei, the sum of the stock prices of all 225 companies is divided by a divisor, which is adjusted for stock splits and other corporate actions to maintain consistency over time.

Factors Influencing the Nikkei Share Index

Several factors can influence the performance of the Nikkei Share Index, including:

- Economic indicators such as GDP growth, inflation, and employment rates.

- Monetary policies set by the Bank of Japan, including interest rates and quantitative easing measures.

- Global market trends and geopolitical events that impact investor sentiment.

Investing in the Nikkei Share Index

For international investors, gaining exposure to the Nikkei 225 can be achieved through various means, including:

- Investing in exchange-traded funds (ETFs) that track the Nikkei index.

- Purchasing individual stocks of companies listed on the Nikkei 225.

- Utilizing derivatives like options and futures contracts for trading strategies.

The Nikkei and the Global Economy

The Nikkei Share Index is not only a reflection of Japan's economic landscape but also serves as a barometer for global market trends. Movements in the Nikkei can influence investor sentiment and market conditions worldwide, especially in Asia-Pacific markets.

Future Outlook for the Nikkei Share Index

As we look to the future, the Nikkei Share Index is expected to remain a key indicator of Japan's economic performance. Factors such as technological advancements, shifts in consumer behavior, and global economic conditions will play a crucial role in shaping the index's trajectory.

Investors should stay informed about changes in economic policies and market dynamics to navigate the complexities of investing in the Nikkei 225.

Conclusion

In summary, the Nikkei Share Index is an integral part of Japan's financial landscape, reflecting the performance of its leading companies and providing insights into the country's economic health. Understanding the Nikkei's components, calculation methodology, and the factors influencing its performance is essential for investors.

We encourage readers to share their thoughts in the comments below, subscribe for updates, and explore more articles related to investing and market insights.

Penutup

Thank you for taking the time to learn about the Nikkei Share Index. We hope this article has provided you with valuable insights and understanding. We invite you to return for more informative content and stay updated on the latest trends in finance and investing.

- Exploring The Life And Career Of Usher Raymond A Musical Icon

- Twin Flames Universe Understanding The Journey Of Spiritual Connection