In the world of finance, understanding stock prices is crucial for investors and analysts alike, particularly when it comes to CRSP stock price. The Center for Research in Security Prices (CRSP) is known for its comprehensive stock market data and indices. This article will delve into the intricacies of CRSP stock prices, exploring their significance, how they are determined, and what implications they hold for investors. With the proper knowledge, individuals can make informed decisions regarding their investments.

As we navigate through this guide, we will uncover various aspects of CRSP stock prices, including historical trends, factors influencing stock prices, and how they compare with other indices. Understanding these elements can help investors better position themselves in the market. Additionally, we will provide valuable resources and data to support our insights, ensuring that you gain a well-rounded understanding of this topic.

Whether you are a seasoned investor or a newcomer to the stock market, this article aims to enhance your knowledge about CRSP stock prices. By the end of this guide, you will have a clearer picture of why CRSP data is essential in making informed investment decisions.

- Stacy Degrandchamp A Comprehensive Look At Her Life And Career

- Zodiac Sign For October 25 Understanding The Traits And Characteristics

Table of Contents

- What is CRSP?

- Understanding CRSP Stock Price

- Historical Data of CRSP Stock Prices

- Factors Affecting CRSP Stock Prices

- Comparison with Other Indices

- Investment Strategies Using CRSP Data

- Resources and Tools for Investors

- Conclusion

What is CRSP?

The Center for Research in Security Prices (CRSP) is a renowned organization that provides extensive historical data on securities traded on the U.S. stock markets. Founded in 1960, CRSP is affiliated with the Booth School of Business at the University of Chicago and is widely used by financial professionals and researchers for its reliable data.

CRSP offers a variety of products, including stock price indices, mutual fund data, and other financial market information. It is particularly known for its comprehensive databases, which include data on stock prices, dividends, and corporate actions. Its datasets are crucial for academic research, portfolio management, and financial analysis.

CRSP Data in Financial Research

CRSP data is often used in financial research to analyze stock performance, study market trends, and develop investment strategies. The accuracy and depth of this data make it a trusted source for many financial services firms and academic institutions.

- Morgan Wallen The Rise Of A Country Music Star

- Matt Damon And His Journey Through The Oscars A Celebration Of Talent

Understanding CRSP Stock Price

CRSP stock prices refer to the prices of stocks listed in the CRSP databases. These prices are updated regularly and reflect the most current trading information available. Understanding how these prices are determined is essential for investors seeking to make informed decisions.

Stock prices in the CRSP database are calculated based on actual trading activity on the stock exchanges. They are influenced by various factors, including market demand, company performance, economic indicators, and broader market trends.

Types of CRSP Stock Prices

CRSP provides different types of stock prices, including:

- Daily Closing Prices: The final price at which a stock is traded at the end of the trading day.

- Adjusted Prices: Prices adjusted for stock splits, dividends, and other corporate actions to provide a more accurate reflection of value over time.

- Monthly Average Prices: Average stock prices calculated over a specific month for trend analysis.

Historical Data of CRSP Stock Prices

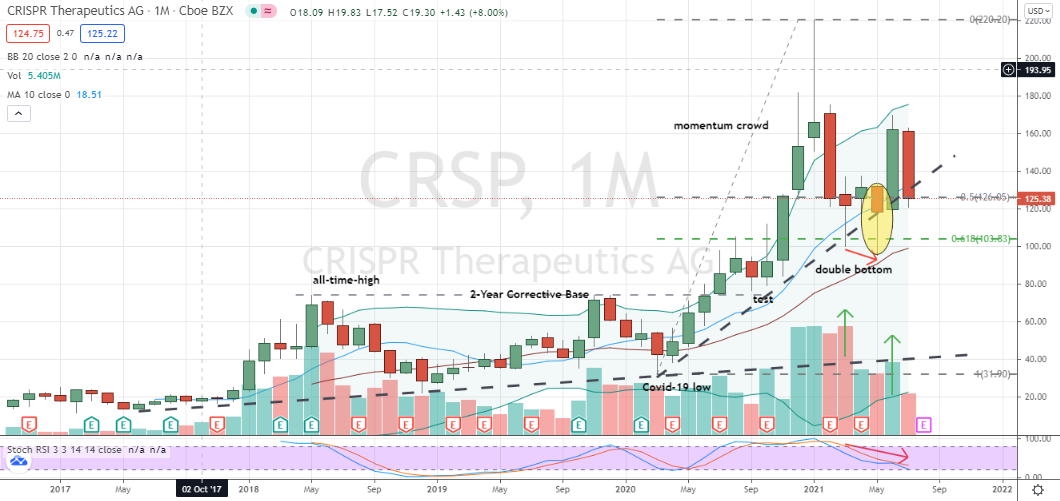

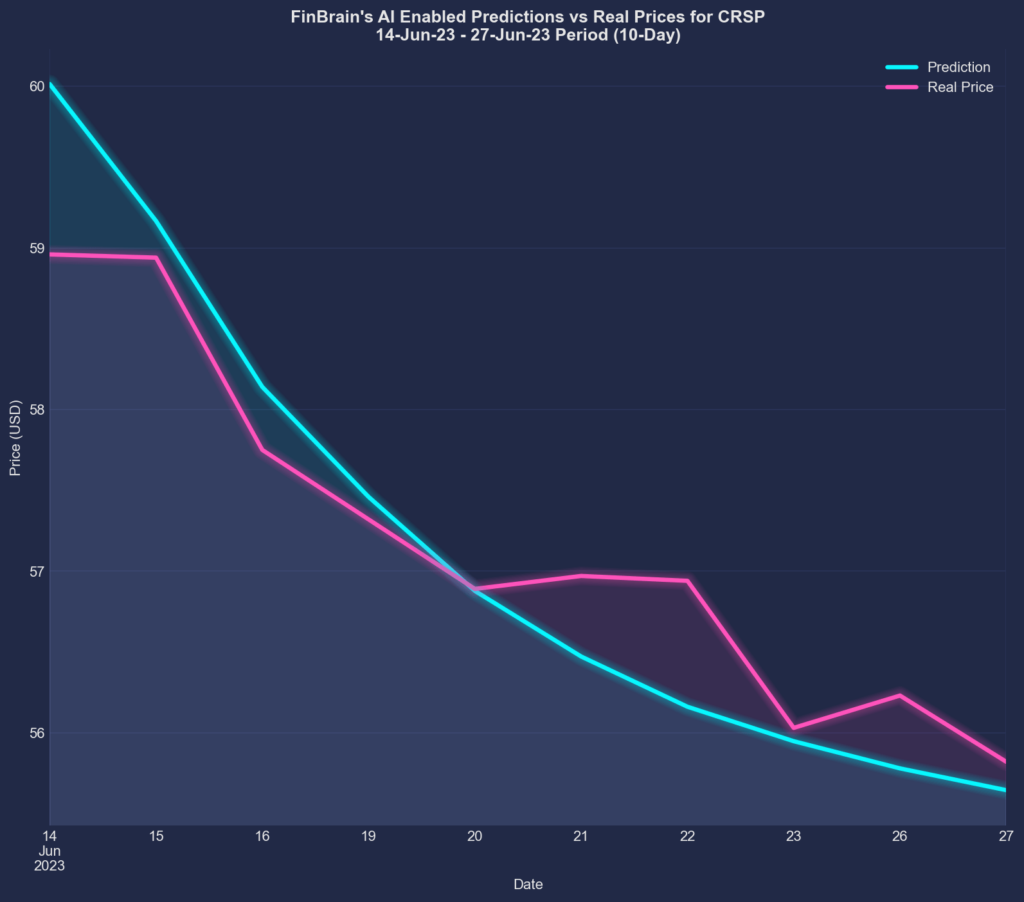

Analyzing historical CRSP stock prices provides insights into market trends and individual stock performance over time. Investors often look at historical data to identify patterns and make predictions about future performance.

CRSP maintains a comprehensive archive of historical stock prices, which can be invaluable for long-term investors. By examining this data, investors can assess how stocks have reacted to various market conditions and corporate events.

Using Historical Data for Analysis

Investors can utilize historical CRSP stock price data to:

- Perform technical analysis to identify trends and patterns.

- Evaluate the performance of individual stocks against market indices.

- Make informed predictions about future stock movements based on past behavior.

Factors Affecting CRSP Stock Prices

Numerous factors can influence CRSP stock prices, and understanding these can help investors make better decisions. Some of the key factors include:

- Company Performance: Earnings reports, revenue growth, and overall financial health significantly impact investor perceptions and stock prices.

- Market Trends: Bull and bear markets can sway stock prices across the board, affecting investor sentiment and trading volume.

- Economic Indicators: Unemployment rates, inflation, and interest rates can all influence stock market performance.

- News and Events: Mergers, acquisitions, and other corporate events often lead to significant price shifts.

Global Economic Impact

In today's interconnected world, global economic conditions also play a role in influencing CRSP stock prices. Events such as geopolitical tensions or international trade agreements can lead to market volatility and affect investor confidence.

Comparison with Other Indices

CRSP stock prices can be compared with other stock market indices such as the S&P 500 or the Dow Jones Industrial Average (DJIA). Such comparisons can provide insights into how individual stocks or sectors are performing relative to the broader market.

For instance, if a particular stock's performance consistently outpaces the S&P 500, it may indicate strong company fundamentals or favorable market conditions. Conversely, underperformance may suggest potential red flags that require further investigation.

Benchmarking Performance

Investors often use CRSP data to benchmark their portfolios against major indices. This benchmarking can help assess whether an investment strategy is effective or if adjustments are necessary.

Investment Strategies Using CRSP Data

Utilizing CRSP stock price data, investors can develop various investment strategies to optimize their portfolios. Some popular strategies include:

- Value Investing: Identifying undervalued stocks based on historical performance and intrinsic value analysis.

- Growth Investing: Focusing on stocks with high growth potential, often characterized by consistent earnings growth.

- Index Investing: Investing in index funds that track CRSP indices for broad market exposure.

Risk Management

Incorporating CRSP data into risk management strategies can help investors mitigate potential losses. By analyzing historical volatility and price trends, investors can make informed decisions about position sizing and diversification.

Resources and Tools for Investors

There are numerous resources available to access CRSP stock price data. Some of the most notable include:

- CRSP Database: The official database provides comprehensive stock price data and analytics tools.

- Financial News Websites: Sites like Yahoo Finance and Bloomberg offer access to real-time stock prices and historical data.

- Brokerage Platforms: Many online brokers provide clients with access to CRSP data for analysis and trading.

Data Analysis Tools

Investors can utilize various data analysis tools and software for deeper insights into CRSP stock prices. Tools such as Excel, R, or Python libraries can help analyze and visualize data effectively.

Conclusion

In conclusion, understanding CRSP stock prices is essential for making informed investment decisions. By analyzing historical data, recognizing the factors influencing stock prices, and leveraging CRSP data in investment strategies, investors can navigate the complexities of the stock market more effectively.

We encourage readers to explore CRSP data further and consider how it can enhance their investment strategies. If you found this article helpful, please leave a comment or share it with others interested in stock market investing.

Thank you for reading, and we hope to see you back for more insightful articles on financial topics.

- Exploring The Enigmatic Folklore Album Cover A Deep Dive Into Its Meaning And Impact

- Venus And Serena Williams Family A Deep Dive Into Their Roots And Relationships