Gold ETFs have emerged as a popular investment vehicle for those looking to gain exposure to gold without the hassle of physical ownership. As a low-cost and convenient option, Gold ETFs allow investors to trade gold as they would with stocks while benefiting from the inherent value of the precious metal. In this article, we will explore what Gold ETFs are, their benefits, risks, and how you can start investing in them.

Gold has historically been viewed as a safe-haven asset, especially during times of economic uncertainty. With rising inflation and geopolitical tensions, many investors are turning to Gold ETFs as a way to hedge against market volatility. This article will provide detailed insights into Gold ETFs, making it an essential read for anyone considering this investment option.

In this guide, we will cover various aspects of Gold ETFs, including their structure, types, performance, and how they fit into an investment portfolio. Whether you are a seasoned investor or just starting, understanding Gold ETFs will equip you with the knowledge needed to make informed investment decisions.

- Discovering The Rich Culture And Heritage Of Irish People

- Kellyanne Conway A Comprehensive Look At Her Life And Career

Table of Contents

- What Are Gold ETFs?

- Benefits of Gold ETFs

- Risks Associated with Gold ETFs

- Types of Gold ETFs

- How to Invest in Gold ETFs

- Performance of Gold ETFs

- Gold ETFs vs. Physical Gold

- Conclusion

What Are Gold ETFs?

Gold ETFs, or Gold Exchange-Traded Funds, are investment funds that trade on stock exchanges and are designed to track the price of gold. Investors can buy shares of these funds, which are backed by physical gold bullion or gold-related assets. Each share of a Gold ETF represents a specific amount of gold, typically measured in ounces.

Unlike mutual funds, Gold ETFs can be bought and sold throughout the trading day at market prices, making them a liquid and flexible investment option. Additionally, Gold ETFs typically have lower expense ratios compared to actively managed funds, making them a cost-effective way to invest in gold.

Benefits of Gold ETFs

Investing in Gold ETFs offers several advantages, including:

- Selena Gomez Show A Deep Dive Into Her Impact On Entertainment

- Olivia Kathleen Bruce A Deep Dive Into The Life And Career Of A Rising Star

- Diversification: Gold ETFs allow investors to diversify their portfolios by adding an asset class that behaves differently from stocks and bonds.

- Liquidity: Investors can buy and sell Gold ETFs on the stock exchange, providing greater liquidity compared to physical gold.

- Lower Costs: Gold ETFs generally have lower management fees compared to other investment vehicles, such as mutual funds.

- Ease of Trading: Investors can easily buy and sell Gold ETFs through their brokerage accounts, just like stocks.

- No Storage Issues: Investing in Gold ETFs eliminates the need for physical storage, insurance, and security concerns associated with owning physical gold.

Risks Associated with Gold ETFs

While Gold ETFs offer various benefits, they also come with certain risks, including:

- Market Risk: Like any investment, Gold ETFs are subject to market fluctuations, and their prices can be volatile.

- Tracking Error: Gold ETFs may not perfectly track the price of gold due to management fees and other factors, which can lead to deviations from the actual gold price.

- Counterparty Risk: Some Gold ETFs invest in gold futures or other derivatives, which may expose investors to counterparty risks.

- Tax Implications: Depending on the jurisdiction, gains from Gold ETFs may be taxed differently than gains from physical gold, affecting overall returns.

Types of Gold ETFs

There are several types of Gold ETFs available to investors, including:

Physical Gold ETFs

Physical Gold ETFs invest directly in gold bullion, holding it in secure vaults. These ETFs aim to track the price of gold closely, providing investors with a direct exposure to the physical asset.

Gold Mining ETFs

Gold Mining ETFs invest in stocks of companies involved in gold mining and production. While these ETFs can provide exposure to gold price movements, they are also influenced by the operational performance of the mining companies.

Gold Futures ETFs

Gold Futures ETFs invest in gold futures contracts, allowing investors to speculate on the future price of gold. These ETFs can be more volatile and are typically suited for experienced investors.

Leveraged Gold ETFs

Leveraged Gold ETFs aim to deliver multiples of the daily performance of gold prices. While they can amplify gains, they also increase the risk of significant losses and are generally not recommended for long-term investing.

How to Invest in Gold ETFs

Investing in Gold ETFs is relatively straightforward. Here are the steps to get started:

- Open a Brokerage Account: Choose a brokerage firm that offers access to Gold ETFs and open an account.

- Research Gold ETFs: Evaluate different Gold ETFs based on their performance, fees, and underlying assets.

- Place an Order: Once you've selected a Gold ETF, place an order through your brokerage account to buy shares.

- Monitor Your Investment: Keep track of the performance of your Gold ETF and make adjustments to your portfolio as needed.

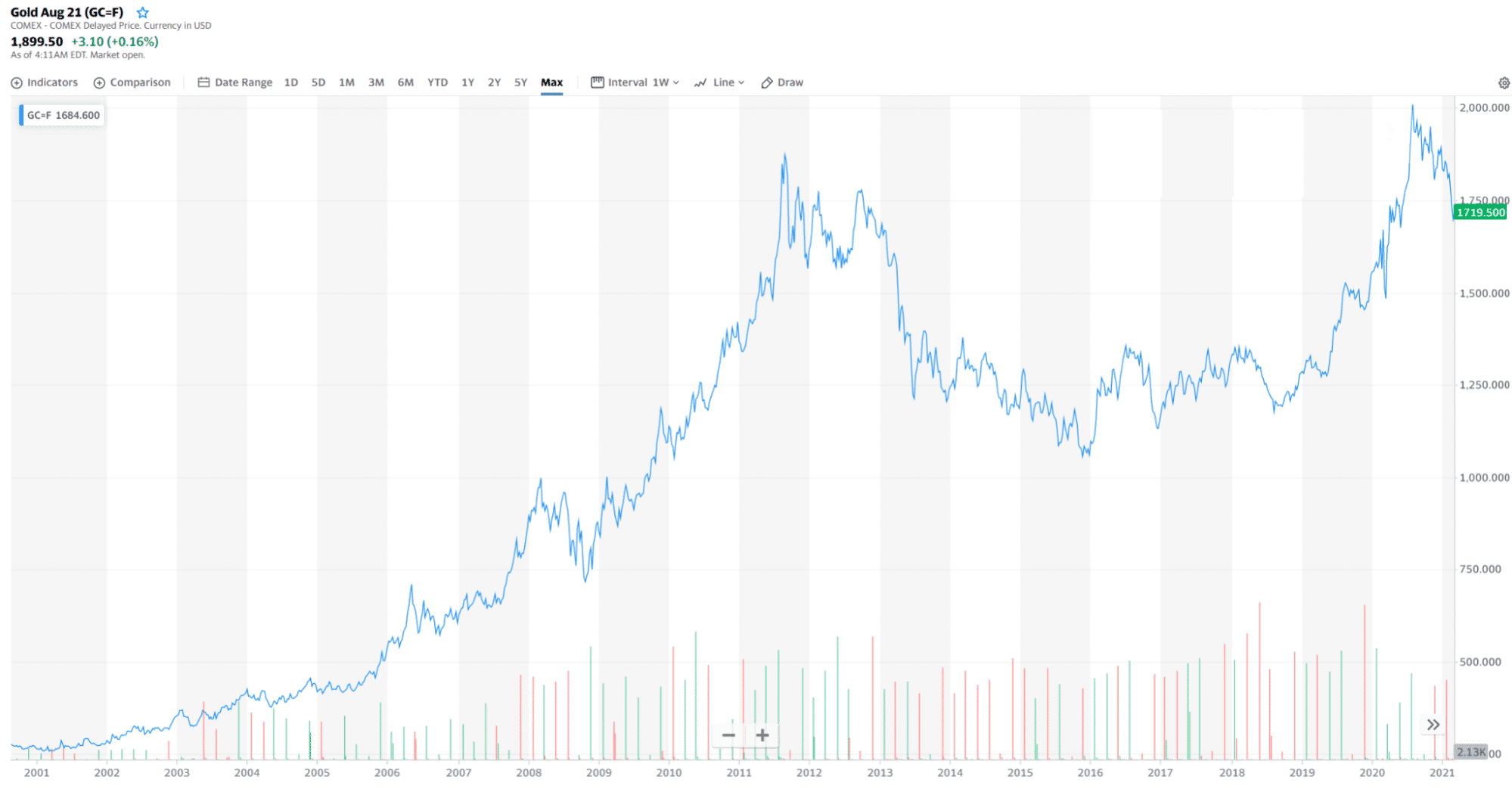

Performance of Gold ETFs

The performance of Gold ETFs largely depends on the price of gold, which can be influenced by various factors, including:

- Economic Conditions: During economic downturns, gold often rises as investors seek safe-haven assets.

- Inflation: Gold is traditionally viewed as a hedge against inflation, leading to increased demand during inflationary periods.

- Geopolitical Tensions: Uncertainty in global politics can drive investors towards gold, impacting its price and ETF performance.

Gold ETFs vs. Physical Gold

When considering an investment in gold, investors often weigh the options between Gold ETFs and physical gold. Here are some key differences:

| Criteria | Gold ETFs | Physical Gold |

|---|---|---|

| Liquidity | High | Low |

| Storage | No | Yes |

| Transaction Costs | Low | High (insurance, storage) |

| Tax Treatment | Varies | Capital gains tax applies |

Conclusion

Gold ETFs offer a convenient and cost-effective way to gain exposure to gold as an investment. With their many benefits, including liquidity, diversification, and lower costs, they present an attractive option for both inexperienced and seasoned investors. However, it's essential to consider the associated risks and understand how Gold ETFs differ from physical gold.

If you're considering investing in Gold ETFs, take the time to research and evaluate which funds align with your financial goals and risk tolerance. Engage with fellow investors, share your thoughts in the comments below, or explore other articles on our site to enhance your investment knowledge.

Final Thoughts

Investing in Gold ETFs can be a valuable addition to your portfolio, especially during uncertain economic times. We encourage you to revisit our site for more insights and updates on the investment landscape. Happy investing!

- Adele Jamaica The Rise Of A Musical Icon

- Exploring The Country Bear Jamboree At Disney World A Timeless Attraction