Home finance rates are a crucial aspect of the home buying process, impacting your monthly payments and overall affordability. With fluctuating interest rates and various financing options available, understanding these rates is essential for making informed decisions. This article delves deep into the nuances of home finance rates, providing you with valuable insights and expert advice to help you navigate the complexities of mortgage financing.

In today's financial landscape, the importance of grasping home finance rates cannot be overstated. Whether you are a first-time homebuyer or looking to refinance your existing mortgage, knowing how rates are determined and what factors influence them will empower you to save money and secure the best loan terms possible. Here, we will explore the various types of home finance rates, their implications, and tips for getting the most favorable rates in the market.

This comprehensive guide aims to equip you with the knowledge necessary to understand home finance rates thoroughly. By the end of this article, you will be well-prepared to make informed decisions about your home financing options, ensuring that you achieve your financial goals while securing your dream home.

- Olivia Kathleen Bruce A Deep Dive Into The Life And Career Of A Rising Star

- Shinedown A Symptom Of Being Human

Table of Contents

- Understanding Home Finance Rates

- Types of Home Finance Rates

- Factors Affecting Home Finance Rates

- How to Get the Best Home Finance Rates

- Impact of Credit Scores on Home Finance Rates

- The Role of the Economy in Home Finance Rates

- Refinancing Your Home Finance Rate

- Conclusion

Understanding Home Finance Rates

Home finance rates refer to the interest rates applied to loans taken out for purchasing or refinancing homes. These rates can significantly influence the total cost of borrowing, making it essential for prospective homeowners to understand how they work. The rates can vary based on several factors, including the type of mortgage, the lender, and the broader economic environment.

What Are Home Finance Rates?

Home finance rates, often termed as mortgage rates, are the costs associated with borrowing money to buy a home. They are typically expressed as an annual percentage rate (APR), which encompasses both the interest charged on the loan and any additional fees that may be incurred over the life of the loan.

Why Do Home Finance Rates Matter?

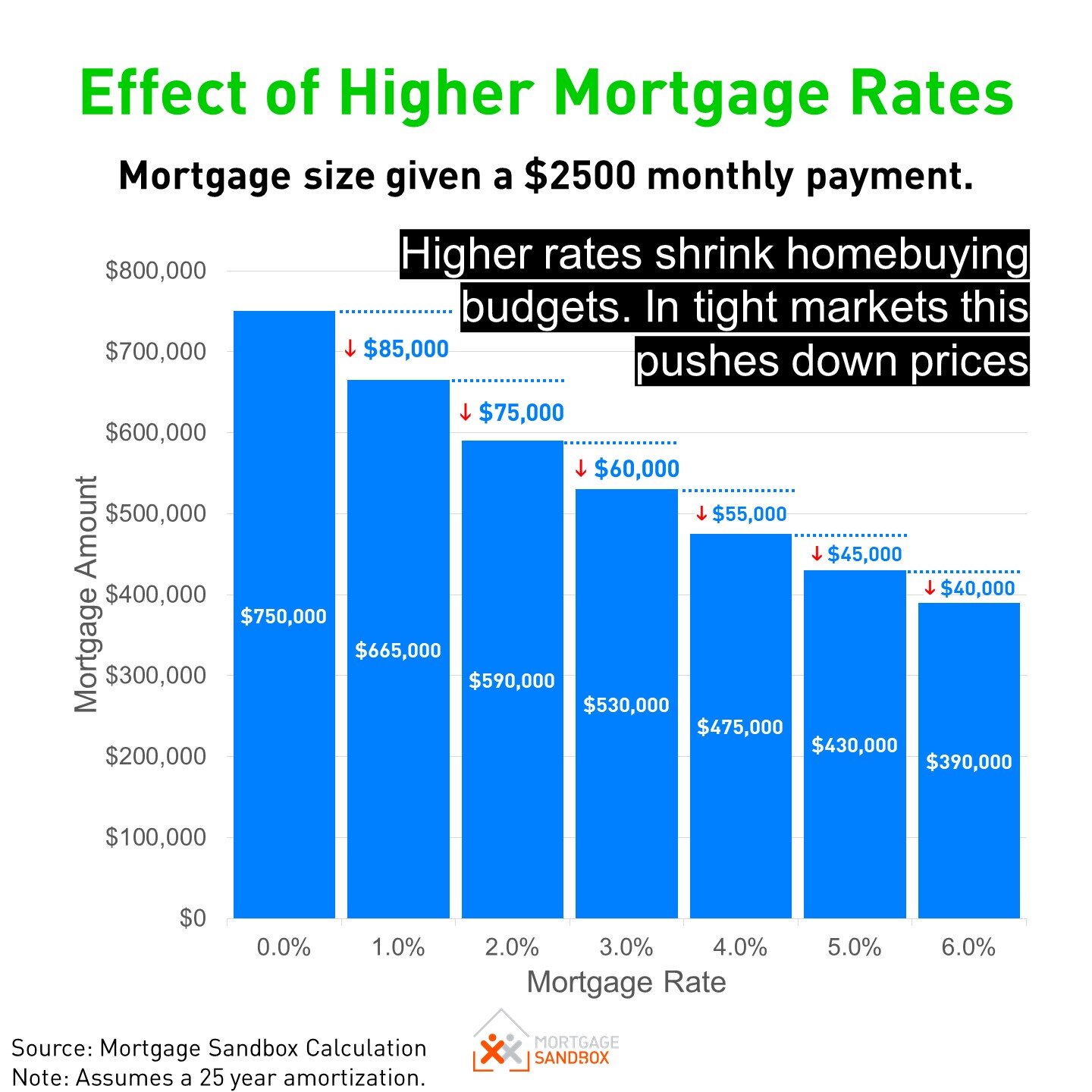

The rate you secure can have a substantial impact on your monthly mortgage payments and the total amount you pay over the term of the loan. Even a slight difference in rates can lead to significant savings or costs over the life of your mortgage. Understanding how to navigate these rates can save you thousands of dollars.

- Eddie Murphy And Charlie Murphy A Deep Dive Into Their Lives And Legacy

- Prince Abdul Mateen The Charismatic Royal Of Brunei

Types of Home Finance Rates

There are two primary types of home finance rates: fixed-rate mortgages and adjustable-rate mortgages (ARMs). Each type has its unique characteristics, advantages, and disadvantages that can greatly affect your financial situation.

Fixed-Rate Mortgages

Fixed-rate mortgages offer a stable interest rate that remains constant throughout the loan term. This predictability makes budgeting easier as your monthly payment will not change, regardless of fluctuations in market interest rates. Fixed-rate mortgages are ideal for those who plan to stay in their homes long-term.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages have interest rates that can change over time, typically after an initial fixed-rate period ends. While ARMs often start with lower rates than fixed-rate mortgages, they can increase, leading to higher monthly payments. They may be suitable for buyers who plan to sell or refinance before the rates adjust.

Factors Affecting Home Finance Rates

Several factors influence home finance rates, which can vary from lender to lender and change over time. Understanding these factors can help you better anticipate changes in rates and make informed decisions.

- Credit Score: A higher credit score typically results in lower interest rates, as lenders view borrowers with higher scores as less risky.

- Loan Amount: The size of the loan can impact the rate. Larger loans may come with slightly higher rates.

- Down Payment: A larger down payment can lower your rate, as it reduces the lender's risk.

- Market Conditions: Economic indicators, inflation rates, and overall demand for mortgages can influence interest rates.

How to Get the Best Home Finance Rates

Securing the best home finance rates involves preparation and a bit of research. Here are some effective strategies to consider:

- Improve Your Credit Score: Pay off debts, make timely payments, and avoid opening new credit accounts before applying for a mortgage.

- Shop Around: Compare rates from multiple lenders to ensure you are getting the best offer.

- Consider the Loan Type: Evaluate the pros and cons of fixed-rate vs. adjustable-rate mortgages to determine the best fit for your financial situation.

- Negotiate: Don’t hesitate to negotiate loan terms and fees with lenders to secure a better deal.

Impact of Credit Scores on Home Finance Rates

Your credit score plays a significant role in determining the interest rate you will receive on your mortgage. Understanding how credit scores affect home finance rates can help you take steps to improve your score before applying for a mortgage.

How Credit Scores Are Calculated

Credit scores are calculated based on several factors, including:

- Payment history

- Credit utilization ratio

- Length of credit history

- Types of credit used

- Recent credit inquiries

Improving Your Credit Score

To improve your credit score, focus on paying bills on time, reducing outstanding debts, and avoiding new credit applications before applying for a mortgage. A higher score can lead to lower interest rates, ultimately saving you money over the life of your loan.

The Role of the Economy in Home Finance Rates

The broader economic environment significantly impacts home finance rates. Understanding how economic factors influence these rates can provide insights into when to buy or refinance a home.

Economic Indicators

Key economic indicators that affect home finance rates include:

- Inflation rates

- Employment rates

- Federal Reserve policies

- Consumer confidence

The Influence of the Federal Reserve

The Federal Reserve's monetary policies, particularly regarding interest rates, directly influence mortgage rates. When the Fed raises or lowers rates, lenders typically adjust their mortgage rates accordingly. Staying informed about Fed announcements can help you anticipate changes in home finance rates.

Refinancing Your Home Finance Rate

Refinancing can be a smart move if interest rates drop or your credit score improves. It allows you to secure a lower rate and reduce your monthly payments or shorten the loan term.

When to Refinance

Consider refinancing when:

- Your current interest rate is significantly higher than the current market rate.

- Your credit score has improved, qualifying you for better rates.

- You want to switch from an adjustable-rate mortgage to a fixed-rate mortgage for stability.

The Refinancing Process

The refinancing process involves applying for a new loan, undergoing a credit check, and closing costs similar to those incurred when obtaining your original mortgage. It’s essential to weigh the potential savings against the costs of refinancing to determine if it’s the right choice for you.

Conclusion

Understanding home finance rates is essential for any prospective homeowner or anyone looking to refinance. By familiarizing yourself with the types of rates, the factors that affect them, and strategies for obtaining the best rates, you can make informed decisions that will save you money and help you achieve your financial goals. Don't hesitate to reach out and share your experiences or questions in the comments below, and feel free to explore other articles on our site for more valuable insights.

- Twin Flames Universe Understanding The Journey Of Spiritual Connection

- Chickfila Breakfast A Complete Guide To The Morning Menu

Detail Author:

- Name : Jennyfer Bogisich II

- Username : cmurray

- Email : delbert36@hotmail.com

- Birthdate : 1996-01-26

- Address : 329 Christiansen Islands South Treva, MS 41295-4699

- Phone : 1-419-839-2140

- Company : Durgan Group

- Job : Compliance Officers

- Bio : Ad dolor qui tempora quam iure. Sed ea dolores dolores sit repellendus. Est est eos consequuntur tempore et ipsa nostrum nulla. Quia et velit similique quia ea quaerat quia.

Socials

tiktok:

- url : https://tiktok.com/@chagenes

- username : chagenes

- bio : Quod enim omnis qui illo minus.

- followers : 498

- following : 1389

linkedin:

- url : https://linkedin.com/in/camren2121

- username : camren2121

- bio : Ea rerum eum omnis.

- followers : 4280

- following : 1084

instagram:

- url : https://instagram.com/hagenesc

- username : hagenesc

- bio : Rerum at deleniti fugiat dolor neque est. Harum incidunt cupiditate neque libero magnam atque.

- followers : 675

- following : 2076

facebook:

- url : https://facebook.com/chagenes

- username : chagenes

- bio : Incidunt officiis est voluptatum provident eius animi ut unde.

- followers : 1250

- following : 1027

twitter:

- url : https://twitter.com/chagenes

- username : chagenes

- bio : Quis voluptatem quo soluta quae. Ut a saepe asperiores accusamus. Nobis velit illum sapiente molestiae rem.

- followers : 6044

- following : 1549