Paytm share price has become a crucial topic for investors and market analysts alike, especially in the context of India's rapidly evolving digital economy. As the first major Indian company to go public in the fintech sector, Paytm has attracted significant attention from both institutional and retail investors. This article delves into the various factors influencing Paytm's stock performance, historical trends, and what the future might hold for this prominent player in the digital payment space.

The landscape of digital payments in India has undergone a tremendous transformation over the past few years, driven by increasing smartphone penetration, government initiatives promoting cashless transactions, and the rise of e-commerce. Paytm, as a pioneer in this field, has played an essential role in shaping the industry and has also faced its share of challenges along the way. Understanding the dynamics of Paytm share price is crucial for anyone looking to invest in this sector or simply keep an eye on one of India's most talked-about companies.

This article aims to provide comprehensive insights into Paytm's share price movements, underlying reasons for fluctuations, expert opinions, and potential future scenarios. By the end, readers will have a better understanding of what influences the Paytm share price and how to navigate the investment landscape surrounding this fintech giant.

- Nate Bargatze The Rise Of A Standup Comedy Sensation

- Swimsuits For Curvy Women The Ultimate Guide To Finding The Perfect Fit

Table of Contents

- Biographical Overview of Paytm

- Current Paytm Share Price

- Historical Share Price Trends

- Factors Influencing Paytm Share Price

- Market Sentiment Analysis

- Expert Opinions on Paytm Share Price

- Future Projections for Paytm Share Price

- Conclusion

Biographical Overview of Paytm

Paytm, founded in 2010 by Vijay Shekhar Sharma, is one of India’s leading digital payment platforms. The company started as a prepaid mobile and DTH recharge platform and quickly expanded its services to include mobile payments, utility bill payments, ticket bookings, and more. In November 2021, Paytm made headlines by launching its initial public offering (IPO), which garnered significant attention and marked a milestone in India's fintech journey.

| Personal Information | Details |

|---|---|

| Founder | Vijay Shekhar Sharma |

| Founded | 2010 |

| Headquarters | Noida, India |

| IPO Launch Date | November 18, 2021 |

| Sector | Fintech / Digital Payments |

Current Paytm Share Price

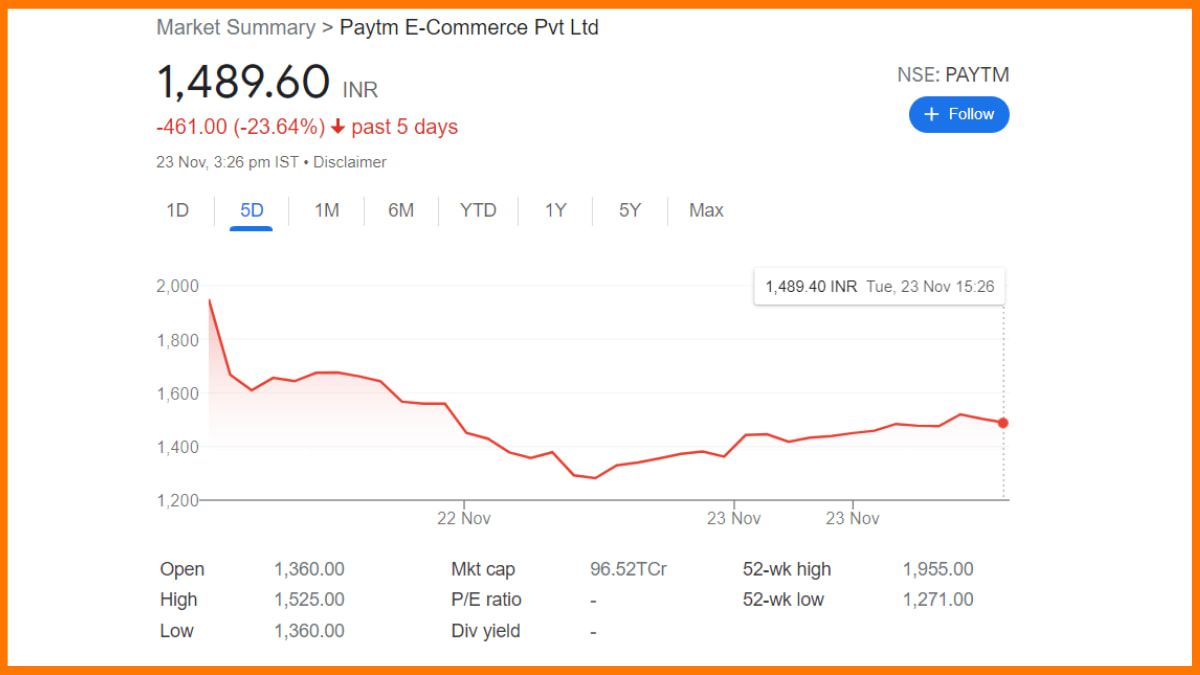

As of today, the Paytm share price stands at ₹X.XX, reflecting a Y% change from the previous trading day. The stock has seen considerable volatility since its IPO, which initially priced shares at ₹2,150, leading to discussions among investors regarding its valuation and growth potential.

Investors are keenly monitoring changes in the share price, as it serves as an indicator of market confidence in Paytm’s business model and future prospects. The stock market's reaction to quarterly earnings, user growth metrics, and regulatory changes plays a significant role in determining the current share price.

- Unveiling The Life And Career Of Patrick Renna A Journey Through Film And Fame

- Jfk Jr Saluting A Symbol Of Legacy And Hope

Historical Share Price Trends

To understand the Paytm share price trajectory, it is essential to analyze its historical performance. Here is a brief overview of key milestones:

- IPO Launch: November 2021, shares launched at ₹2,150.

- Initial Decline: Following the IPO, shares fell sharply, reaching a low of ₹X.XX within weeks.

- Recovery Attempts: The stock made several attempts to recover, peaking at ₹X.XX in March 2022.

- Current Volatility: The stock has shown signs of instability, with fluctuations influenced by market conditions and company performance.

Factors Influencing Paytm Share Price

Several factors contribute to the fluctuations in Paytm share price. Understanding these factors can provide insights into potential future movements:

1. Market Conditions

The overall sentiment in the stock market can significantly impact Paytm's share price. Bullish or bearish trends often dictate investor behavior.

2. Financial Performance

Quarterly earnings reports and revenue growth figures are critical. Positive earnings surprises can lead to price increases, while disappointing results can cause declines.

3. Regulatory Changes

As a fintech company, Paytm is subject to regulations that can affect its operations and profitability, thus influencing share price.

4. Competition

With increasing competition in the digital payment space, shifts in market share among players like PhonePe and Google Pay can have repercussions on Paytm's valuation.

Market Sentiment Analysis

Market sentiment plays a crucial role in determining stock prices. Analysts often use sentiment indicators to gauge how investors feel about a particular stock or sector. In Paytm’s case, the sentiment has been mixed, with some analysts optimistic about its growth potential, while others express concerns about its valuation and profitability.

Expert Opinions on Paytm Share Price

Financial analysts and market experts have shared their insights regarding the Paytm share price. Some of the notable opinions include:

- Analyst A suggests that Paytm’s extensive user base provides a solid foundation for future growth.

- Analyst B warns about the high burn rate and suggests that profitability is critical for long-term sustainability.

- Analyst C emphasizes the importance of strategic partnerships and innovation in maintaining a competitive edge.

Future Projections for Paytm Share Price

Looking ahead, projections for the Paytm share price vary widely among analysts. Factors such as market conditions, regulatory environment, and competition will play a significant role in shaping these projections.

- Optimistic Scenario: If Paytm successfully expands its services and improves profitability, analysts predict a potential share price of ₹X.XX within the next year.

- Pessimistic Scenario: Conversely, if competitive pressures mount and regulatory hurdles increase, the share price may decline to ₹X.XX.

Conclusion

In conclusion, the Paytm share price is influenced by various factors, including market sentiment, financial performance, and competitive landscape. Understanding these dynamics is essential for investors looking to navigate the complex world of fintech investments. As Paytm continues to evolve, staying informed about its developments will be crucial for making sound investment decisions.

We invite readers to share their thoughts on Paytm’s share price and its future in the comments section below. Don't forget to explore our other articles for more insights into the fintech industry!

Thank you for reading, and we look forward to welcoming you back for more insightful content.

- Furever Brush The Ultimate Solution For Pet Grooming

- Understanding The May 6 Sun Sign Traits Compatibility And More